car sales tax illinois vs wisconsin

There is also between a 025 and 075 when it comes to county tax. AUTO INSURANCE PREMIUMS FOR FULL COVERAGE IN ILLINOIS vs.

Lowest Tax Rates Anderson Auto Group

That way you dont have to deal with the fuss of trying to follow each states.

. The sales tax charged on car purchases in Wisconsin is 5 so you can expect to pay at least 5 of the total vehicle price for the tax fee. 805 E Green Bay Ave Saukville WI 53080. Wisconsin is one of the cheapest states to buy a car.

775 for vehicle over 50000. Find the latest United States sales tax rates. Just curious if I have to pay Wisconsin sales tax on the car buying at a dealer and Illinois sales tax.

This is mostly due to the higher-than-average insurance premium cost of 1905 and car maintenance costs which are 422 on average. The car dealer will follow the sales tax collection laws of their own state. Unless of course you reside in those Metro-East communities with a 65 tax on vehicle sales.

Car tax as listed. As this years tax-filing deadline April 18 comes closer its. Indiana IN Sales Tax Rates.

Insurance premiums are the second lowest in the country. 26 rows Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate. More about the Wisconsin Income Tax.

Form RUT-50 is generally obtained when you license and title your vehicle at the local drivers license facility or currency exchange. 500 X 06 30 which is. Thats 2025 per 1000.

Wisconsin WI Sales Tax Rates. For example sales tax in. Wed Jul 01 2020.

Is it better to live in Illinois or Wisconsin. Form RUT-50 Private Party Vehicle Use Tax Transaction Return. 2020 rates included for use while preparing your income tax deduction.

For vehicles that are being rented or leased see see taxation of leases and rentals. However if a vehicle purchased in another state the District of Columbia or the Commonwealth of Puerto Rico is subject to sales tax in that jurisdiction a credit against Wisconsin sales or use tax due is allowed for sales tax paid to that jurisdiction up to the amount of Wisconsin tax due sec. Illinois has recent rate changes Wed Jul 01 2020.

Form RUT-50 Private Party Vehicle Use Tax Transaction Return due no later than 30 days after the purchase date of the vehicle. Select the Illinois city from the list of popular cities below to see its current sales tax rate. When Chicago has everything you need as a young professional we forget about Illinois neighbor to the north.

Youre supposed to pay it when the vehicle gets. With local taxes the total sales tax rate is between 6250 and 11000. Eric von Schledorn Chevrolet Buick Cadillac.

Texas residents also dont pay income tax but spend 18 of their income on real estate taxes one of the highest rates in the country. If you need to obtain the forms prior to registering the vehicle send us an email request or call our 24-hour Forms Order Line at 1 800 356-6302. 635 for vehicle 50k or less.

2297 139 of the average sales price. 425 Motor Vehicle Document Fee. Average Salary Tax Accountant Milwaukee - 60041.

In addition to state and county tax the City of Chicago has a 125 sales tax. Owning a car for three years is 2258 more expensive. The type of license plate youre buying.

Is it better to live in Illinois or Wisconsin. 2284 138 of the average sales price. Illinois IL Sales Tax Rates.

Imagine that your monthly lease payment is 500 and your states sales tax on a leased car is 6. Since the Missouri tax appears to be 4225 and the standard Illinois tax on vehicle sales is 625 you must pay the 2025 difference. Just curious if I have to pay Wisconsin sales tax on the car buying at a dealer and Illinois sales tax.

Wisconsin residents must pay a 5 percent sales tax on car purchases plus county taxes of up to 05 percent Some counties also charge a stadium tax of 01 percent notes the Wisconsin Department of RevenueFor example the state and local sales tax on vehicles registered in Bayfield County is 55 percent. More about the Illinois Income Tax. Owning a car for one year in New Jersey is 527 more expensive than the national average.

I know I wont be able to avoid the Illinois tax man but how about Wisconsin. Gas prices and maintenance fees are lower than most states. The state sales tax rate in Illinois is 6250.

Typically when you buy a car in a different state than your home state the car dealer collects your sales tax at the time of purchase and sends it to your home states relevant agency. Car sales tax rate is 575 which is slightly higher than other states. The national average state and local sales tax by.

Sales tax for a leased vehicle is calculated based on the states tax percentage and the cost of the lease payments. Illinois collects a 725 state sales tax rate on the purchase of all vehicles. Then the difference is 2275.

Form ST-556 Sales Tax Transaction Return. 2061 125 of the average sales price. Read our guide to car insurance in Illinois versus Wisconsin and take the strain out of your move.

Additionally sales tax varies from city to city in Illinois. Whether the car is purchased used or new. 1869 113 of the average sales price.

Below are some more examples of the average fees in various expensive states that will make a significant dent in car buyers pockets. In addition there may be county taxes of up to 05 along with a stadium tax of up to 01. Compare these to California where residents owe almost 5 of their income in sales and excise taxes and just 076 in real estate tax.

If you had the vehicle titled in another state for more than three months no Illinois tax is due but you still must file Form RUT-25 to reflect that fact. If you try to register the car in Illinois youll have to pay use tax at the time of registration on the difference between the sales tax paid to the state where you purchased and the Illinois rate generally 625 but higher in the collar counties. Purchase prices are higher than in North Carolina and Missouri.

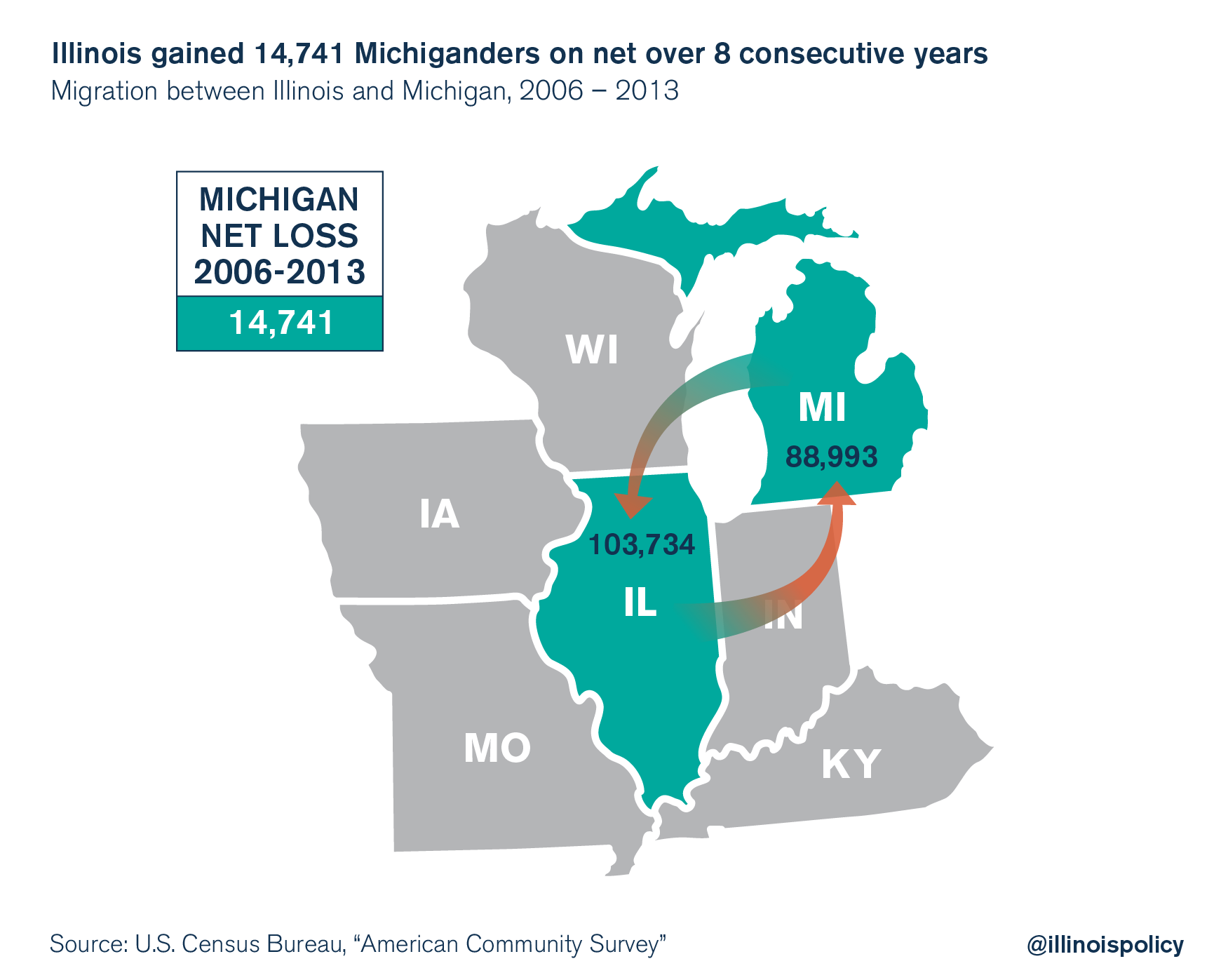

Michigan Has Reversed The Flow Of Interstate Migration With Illinois

Illinois State Taxes 2022 Tax Season Forbes Advisor

Car Tax By State Usa Manual Car Sales Tax Calculator

Destination Based Sales Tax Assistance Effective January 1 2021 Sales Taxes

What S The Car Sales Tax In Each State Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

Illinois Imposing Car Trade In Tax On Jan 1 Dealers Call It Double Taxation

States With Highest And Lowest Sales Tax Rates

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

New 2017 Polaris Rzr Xp Turbo Eps Atvs For Sale In Wisconsin 2017 Polaris Rzr Xp Turbo Eps Polaris Rzr Xp Polaris Rzr Rzr

Illinois Has The Highest Taxes Nationwide Report Finds Mystateline Com

What S The Car Sales Tax In Each State Find The Best Car Price

What Is Illinois Car Sales Tax

State Corporate Income Tax Rates And Brackets Tax Foundation

What Is The Sales Tax On A Car In Illinois Pasquesi Sheppard Llc

What S The Car Sales Tax In Each State Find The Best Car Price