how much taxes are taken out of paycheck in michigan

In Michigan all forms of compensation except for qualifying pension and retirement payments are taxed at the same flat rate of 425. The median household income is 54909 2017.

Understanding Payroll Taxes And Who Pays Them Smartasset

For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax.

. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. This rate applies to both single and. Combined the FICA tax rate is 153 of the employees wages.

Supports hourly salary income and multiple pay frequencies. Social Security has a wage base limit which for 2022 is 147000. The percentage that is taken out of your paycheck depends on your exemptions and the amount of money you make.

If you had federal taxes withheld from your unemployment benefits throughout the year its possible the new 10200 exemption will make you eligible for a refund. In Michigan adjusted gross income which is gross income minus certain deductions is based on federal adjusted gross income. The next 30249 you earn--the amount from 9876 to 40125-.

For a single filer the first 9875 you earn is taxed at 10. For employees earning more than 200000 the Medicare tax rate goes up by an additional 09. This 153 federal tax is made up of two parts.

Therefore FICA can range between 153 and 162. The money for these accounts comes out of your wages after income tax has already been applied. Unlike most states Michigan uses a flat withholding tax rate of 425.

Use ADPs Michigan Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Some deductions from your paycheck are made post-tax. Do any of your employees make over 137700.

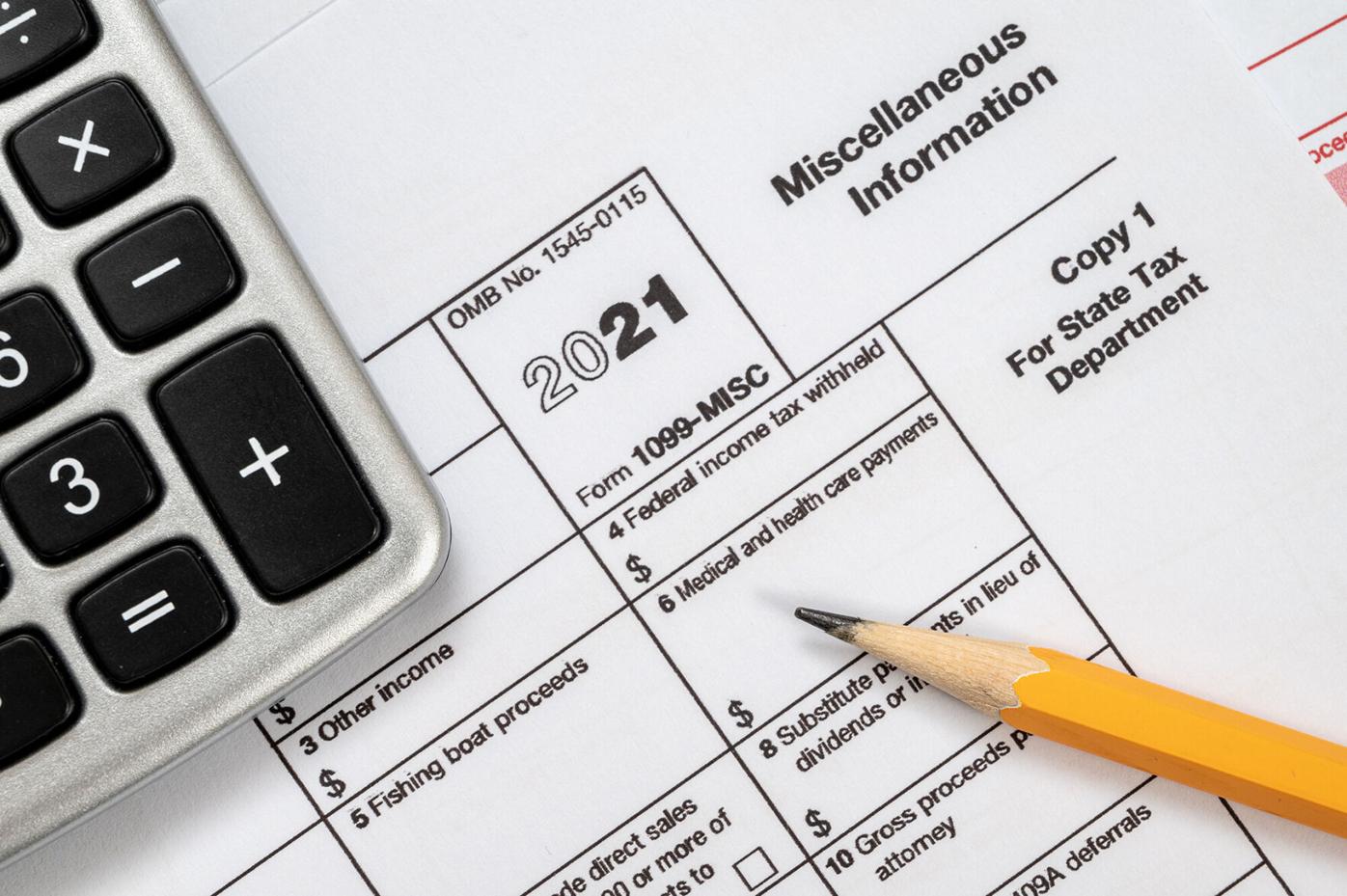

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Automatic deductions and filings direct deposits W-2s and 1099s. Switch to Michigan hourly calculator.

The federal Fair Labor Standards Act FLSA and Michigans Payment of Wages and Fringe Benefits Act PWFBA allow employers to take legally authorized and voluntarily agreed upon deductions from your paycheck. Switch to Michigan salary calculator. Amount taken out of an average biweekly paycheck.

Generally around 15 is taken out of each paycheck and held for taxes social. How do I calculate how much tax is taken out of my paycheck. How much taxes are taken out of paycheck in michigan Monday February 28 2022 Edit.

The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. Total income taxes paid.

A 100000 Michigan salary is trimmed to 72018 by federal and state taxes including an estimated 408 state income tax bite. Why Gusto Payroll and more Payroll. Amount taken out of an average biweekly paycheck.

So you wont get a tax withholding break from supplemental wages in Michigan. Check out our new page Tax Change to find out how federal or state tax changes. This free easy to use payroll calculator will calculate your take home pay.

These include Roth 401k contributions. Calculates Federal FICA Medicare and withholding taxes for all 50 states. Looking for managed Payroll and benefits for your business.

This Michigan hourly paycheck calculator is perfect for those who are paid on an hourly basis. Michigan has a population of over 9 million 2019 and is widely known as the center of the United States automotive industry with the Big Three all headquartered in Detroit. For those age 50 or older the limit is 27000 allowing for 6500 in catch-up contributions.

The 10200 unemployment tax exemption only applies to 2020. According to PA 82 and 83 of 1991 an Accelerated Withholding Tax filer is required to remit withholding taxes the same day as federal payments regardless of the amount due. However you can still boost your paycheck through.

For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. Taxpayers who have an annual Withholding liability of 480000 in the preceding calendar year. 8 New or Improved Tax Credits and Breaks for Your 2020 Return.

Michigan income tax withholding. Social Security and Medicare taxes. The IRS will automatically calculate this and give you a refund if necessary.

Examples of legally authorized deductions are. The income tax is a flat rate of 425. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare.

Total income taxes paid. Local income tax ranging from 1 to 24. The current rate for Medicare is 145 for the employer and 145 for the employee or 29 total.

124 to cover Social Security and 29 to cover Medicare. Use this paycheck calculator to figure out your take-home pay as an hourly employee in Michigan. In addition to withholding based on.

This differs from some states which tax supplemental wages at a different rate. For 2022 the limit for 401 k plans is 20500. Overview of Michigan Taxes Gross Paycheck 3146 Federal Income 1532 482 State Income 507 159 Local Income 350 110 FICA and State Insurance Taxes 780.

Its important to note that there are limits to the pre-tax contribution amounts. Federal income taxes are paid in tiers. Accelerated EFT Filing Requirements.

Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan paycheck calculator.

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Online Taxes Tax Refund

2022 Federal Payroll Tax Rates Abacus Payroll

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Online Taxes Tax Refund

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Complaint Comparison Allstate Geico Progressive And State Farm Car Insurance Auto Insurance Quotes Insurance Quotes

1 000 After Tax Us Breakdown July 2022 Incomeaftertax Com

Tax Cuts Are Coming But Michigan Is Already A Low Tax State Citizens Research Council Of Michigan

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Many People Live Paycheck To Paycheck And Missing Any Time Because Of A Workplace Accident Can Result I Paying Taxes Worker Social Security Disability Benefits

Paycheck Calculator Take Home Pay Calculator

Paycheck Taxes Federal State Local Withholding H R Block

Michigan Will Begin Accepting Income Tax Returns Jan 24 State Abc12 Com

2022 Federal State Payroll Tax Rates For Employers

Paycheck Calculator Take Home Pay Calculator

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal